Companies Hiring Now

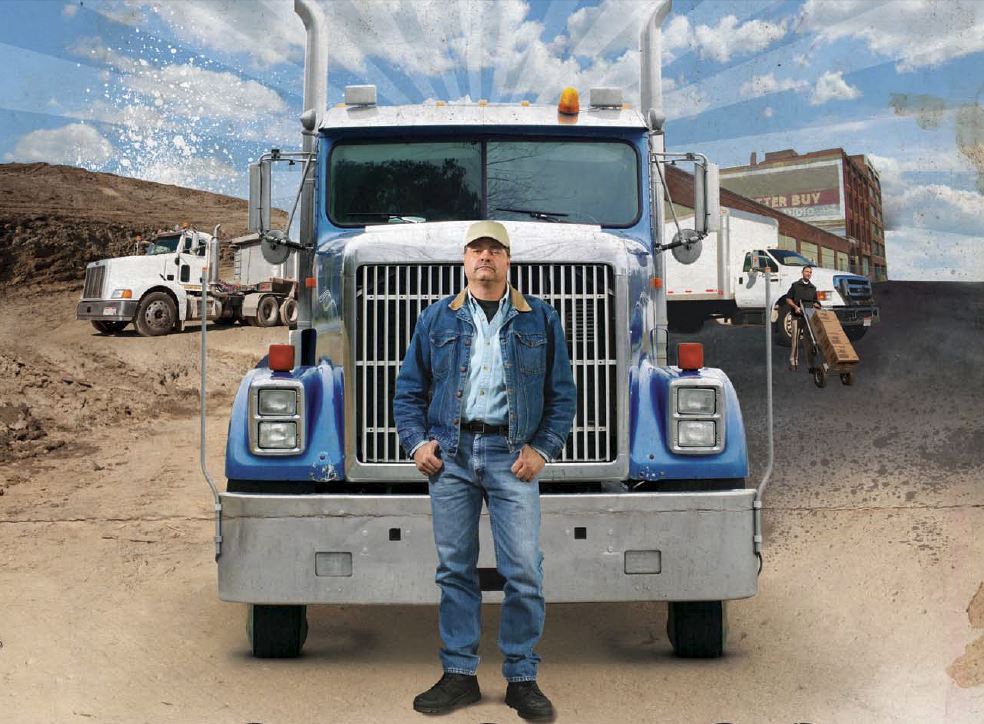

With decades of OTR experience, we have helped

thousands of drivers find the right fit and job.

“If you are an experienced driver looking for a new opportunity, AskTheTrucker can connect you many regional or local routes.”

Jason D. – WalMart OTR

“I was able to get back into hot-shot work after working with Allen to find dedicated routes in Indiana.”

Tommy D. – Indiana Owner-Operator

Reefer Repair Services: Keep Your Refrigerated Units Running Smoothly

Reefer repair services are essential for maintaining the efficiency and reliability of refrigeration units in the transportation industry. These services cater to the specific needs of customers who own or operate refrigerated units, such as Thermo King and Carrier. By providing professional, timely, and cost-effective solutions, reefer repair service providers play a crucial role in…

Texas Commercial Truck Insurance Requirements

Essential Truck Insurance Coverage for Lone Star State Drivers Trucking insurance is an essential aspect of operating a commercial trucking business in Texas. With the state’s vast transportation industry, truck owners and operators need to secure insurance coverage to protect their assets and comply with regulatory requirements. Comprehensive trucking insurance policies account for various liabilities,…

How Much Does Cargo Insurance Cost?

Cargo insurance is a critical aspect for businesses in the transport sector, particularly those involved in the shipment of goods by truck, air, and sea. It offers financial protection and peace of mind by covering damages or losses to the cargo while in transit. For companies involved in the supply chain, understanding cargo insurance costs…

Auto Hauler Insurance Requirements: Essential Coverage Guide

Commercial insurance for auto haulers is a crucial aspect for owner-operators and businesses involved in the transportation of vehicles. Whether a small or large hauler, having the appropriate coverage ensures protection from potential risks and liabilities while operating in this industry. It is essential to understand the different types of insurance requirements and the factors…

California Commercial Truck Insurance Requirements

If you want to operate a commercial truck in California, you’ll need to meet certain insurance requirements. Requirements for California truck insurance will depend on a few factors, including what you’re hauling and the type of vehicle you’re operating. Whether you plan to operate interstate or intrastate, it’s important to understand the types of coverage…

Progressive Commercial Insurance

Progressive is one of the most prominent insurance companies in the United States, and the company provides insurance policies designed for truckers. We rate them as the #1 rated company for commercial truck coverage. You’ll find that Progressive offers insurance for trucks of all kinds, including: Three main insurance options are offered: Progressive Owner Operator…

Top 10 Commercial Truck Insurance Companies

If you drive a semi-truck or operate a company that hauls freight, trucking insurance is necessary to meet legal requirements and to protect yourself and your business. In this post, we will introduce you to the best commercial trucking insurance companies. But before we do, let’s discuss who needs to purchase trucking insurance and what…

Truck Insurance Exchange

Truck Insurance Exchange (TIE) is part of the Farmers Insurance Group (FIG). TIE is an insurer that has held an unlimited, normal license to offer insurance out of California since 1935. For over 85 years, people have put their trust in TIE and its services. Truck Insurance Exchange has written over 19 million policies, and…